492.1 Introduction

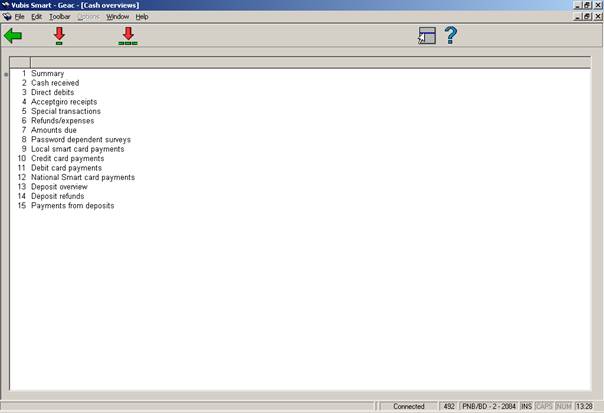

This AFO determines how the cash register overviews are compiled: what they contain and how they are displayed. The system can produce the following overviews:

·

Summary

This is an overview of the receipts in cash, via bank and giro accounts and from special transactions, including totals.

·

Cash receipts

This is an overview of the cash receipts.

·

Bank receipts

This is an overview of the receipts through a bank account.

·

Giro receipts

This is an overview of the receipts through a giro account.

·

Special transactions

This is an overview of all special transactions.

·

(Refund) payments/expenses

This is an overview of all payments made to borrowers and all income that cannot be registered using the ‘normal’ procedures.

·

Amounts due

This is an overview of all amounts due at a given point in time.

·

Password-related overviews

These are password-related overviews of all cancelled amounts, refunds, cash register discrepancies and free receipts.

· Card-reader receipts.

These overviews can be displayed per:

· location;

· cash register;

· type of receipt;

· item category;

· borrower category;

· variable period.

The overviews are also variable with reference to:

· the amounts displayed:

- absolute amounts,

- gross amounts,

- VAT percentages,

- VAT amounts,

- net amounts;

· the number of lines per page;

· the number of characters per line;

· the margin on the left.

Output is performed using the standard output procedure. The overviews that can be generated using AFO 492 are updated using AFO 493 (‘Generate periodical overviews’).

492.2 Financial overviews

After choosing this AFO the following form will be displayed.

Fields on the screen

Type of presentation: Indicate how the overviews are to be presented. You may choose from:

· default

· select display type.

Selecting the ‘default presentation’ will shorten the working method in this AFO by a considerable amount of time. The default presentation is defined using AFO 494 (‘System file control’).

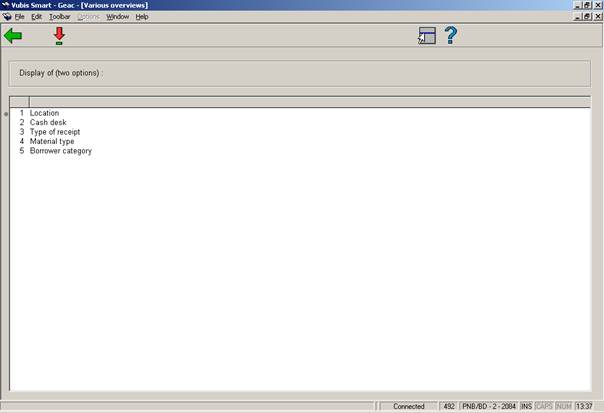

Next an overview screen is displayed in which the available financial overviews are listed

Options on the screen

: Select one or more line numbers and then this option to compile one or more financial overviews. The overviews ‘Amounts due’ and ‘Password-related overviews’ cannot be selected at the same time as other types.

: Select this option to compile all of the financial overviews listed.

The fifteen lines on the screen are described in the next sections. This is done on the assumption you have chosen the free presentation, i.e. the extended method.

492.3 Summary

When you select this option, an overview screen will be displayed listing the information that can be used to compile a financial summary.

Options on the screen

: Select two items from the list and then this option to select the information on the basis of which you want to compile a financial overview. You must select two of the following possibilities:

· Location

· Cash register;

· Type of receipt;

· Item category;

· Patron category.

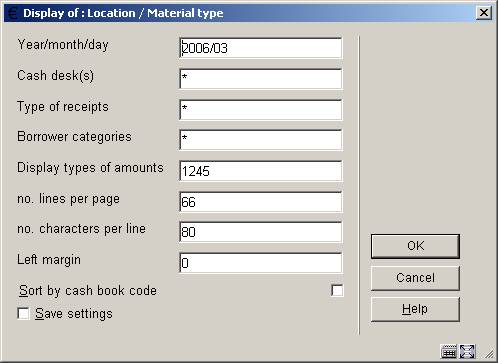

Then an input screen will be displayed:

Fields on the screen

Year/month/day: Enter the period over which you want to view a financial overview. This period can be freely determined. A few examples are given:

|

Format |

Example |

Overview |

|

yyyy |

95 |

for a year |

|

yyyy/mm |

95/03 |

for a month |

|

yyyy/mm/dd |

95/03/09 |

for one day |

|

yyyy-yyyy |

95‑96 |

for more than one year |

|

yyyy/mm-yyyy/mm |

95/01‑95/03 |

for more than one month |

|

yyyy//mm/dd-yyyy/mm/dd |

95/03/01‑95/03/12 |

for more than one day |

Location: Enter one or more location codes (or a combination of one or more agency and location codes). Separate the codes using a “,” (comma). Enter a “*” (star) if you want to view all codes.

Please note!

This field is not displayed if you have selected ‘Location’ as one of the two display options.

Cash desk(s): Enter one or more cash register codes. Separate the codes using a “,” (comma). Enter a “*” (star) if you want to view all codes.

Please note!

This field is not displayed if you have selected ‘Cash desk’ as one of the two display options.

Type of receipts: Enter one or more types of receipt, for example “L” (loan charge), “B” (fine). These codes are listed in AFO 491. Separate the codes using a “,” (comma). Enter a “*” (star) if you want to view all codes.

Please note!

This field is not displayed if you have selected ‘Type of receipt’ as one of the two display options.

Item category: Enter one or more codes for the nature of the items. Separate the codes using a “,” (comma). Enter a “*” (star) if you want to view all codes.

Please note!

This field is not displayed if you have selected ‘Material type’ as one of the two display options.

Borrower category: Enter one or more borrower categories. Separate the codes using a “,” (comma). Enter a “*” (star) if you want to view all codes.

Please note!

This field is not displayed if you have selected ‘Borrower category’ as one of the two display options.

Display type of amount: The system can display the following types of amounts on an overview:

· absolute numbers (no amounts) (1);

· gross amounts; (2)

· VAT percentages; (3)

· VAT amounts; (4)

· net amounts. (5)

Enter the desired numbers (amount types).

Please note!

When the numbers 3, 4 and 5 have been selected, the information will only be correct if you have opted for a presentation per type of receipt, further specified per nature of the item. The VAT percentages are linked to the types of receipt combined with the nature of the items.

Number of lines per page: Enter the number of lines that can be printed on each page.

Number of characters per line: Enter the number of characters that can be printed on each line (maximum 132).

Left margin: Enter the width of the margin on the left (number of characters).

Sort by cash book code: Indicate whether or not the amounts are to be sorted according to cash register accounting code.

492.4 Cash received

The method for this option is the same as for the Summary (section 492.3).

492.5 Direct debits

The method for this option is the same as for the Summary (section 492.3).

492.6 Acceptgiro receipts

The method for this option is the same as for the Summary (section 492.3).

492.7 Special transactions

The method for this option is the same as for the Summary (section 492.3).

492.8 Refunds / expenses

The method for this option is the same as for the Summary (section 492.3).

492.9 Amounts due

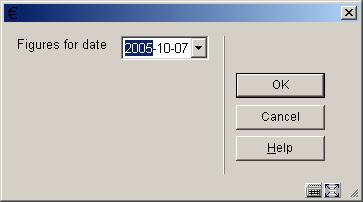

After choosing this option the following form will be displayed:

Figures for date: Enter the date for which you want to view a financial overview. Naturally, only those dates for which an overview of amounts due has been generated (‘Generate periodical overviews’) can be entered in this field. The system will propose as default date the last date upon which an overview of amounts due was generated.

Then an overview screen will be displayed listing the information on the basis of which a financial overview can be compiled. Other than this, the working method is the same as that for ‘Summary’.

492.10 Password dependant surveys

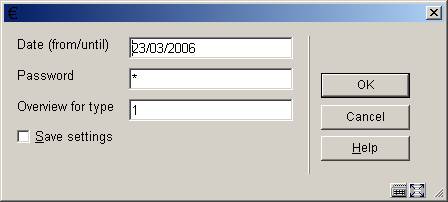

After choosing this option the following form will be displayed:

Fields on the screen

Date (from/until): Enter the starting date and, if desired, the end date of the period over which you want to view an overview. The following formats may be used:

|

Format |

Example |

Meaning |

|

dd/mm/yyyy |

25/02/1996 |

one day |

|

dd/mm/yyyy- |

25/02/1996‑ |

from |

|

dd/mm/yyyy-dd/mm/yyyy |

25/02/1996‑27/02/1996 |

from-to |

Password: Enter one or more passwords for which you want to view an overview. Separate multiple codes using a “,” (comma). Enter a “*” (star) if you want to view overviews for all passwords.

Overview for type: Enter one or more numbers in of the types for which you want to compile an overview. Separate the type codes using a delimiter. You may choose from:

· cancelled amounts;

· refunds (as registered using AFO 417 ‘Payment control/free receipts’);

· cash discrepancies (as registered using AFO 491 (‘Up-to-date overviews of amounts received);

· free receipts (as registered using AFO 417).

Now the system will switch to the standard output procedure.

492.11 Local smart card payments

The method for this option is the same as for the Summary (section 492.3).

492.12 Credit card payments

The method for this option is the same as for the Summary (section 492.3).

492.13 Debit card payments

The method for this option is the same as for the Summary (section 492.3).

492.14 National smart card payments

The method for this option is the same as for the Summary (section 492.3).

492.15 Deposit overview

The method for this option is the same as for the Amounts due (section 492.9).

492.16 Deposit refunds

The method for this option is the same as for the Summary (section 492.3).

492.17 Payments from deposits

The method for this option is the same as for the Summary (section 492.3).